Circular sourcing

Few purchasing departments are yet taking full advantage of the circular economy. However, for certain purchasing categories of purchases, circular sourcing can reduce costs, secure supplies of critical materials and components, and lower the carbon footprint of the purchasing function.

Why circular sourcing?

Materials cost for industrial companies is increasing…

Labor productivity has increased much more rapidly than the productivity of materials or energy. For example, labor productivity in the United States tripled between the 1950s and the 2000s, while the productivity of materials and energy changed very little. Tax policies, which emphasize labor taxation rather than resource taxation, have also favored increasing labor productivity at the expense of resource productivity.

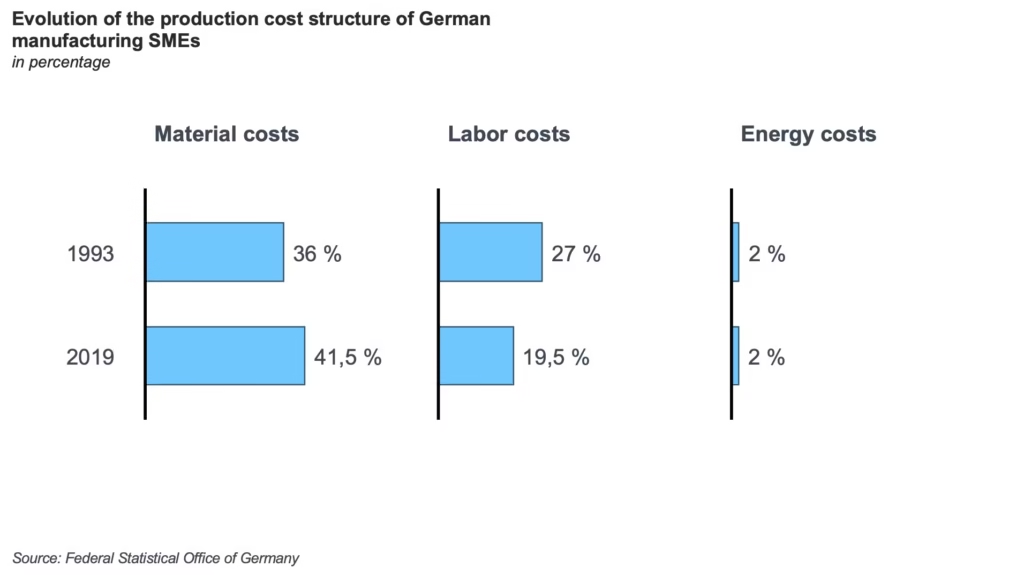

Over the past 20 years, the share of labor costs in the total cost structure of German industrial enterprises has decreased by 9%, while the share of material costs has increased by 7% (see figure). Today, materials represent the largest cost component for industrial companies, accounting for 43% in Germany.

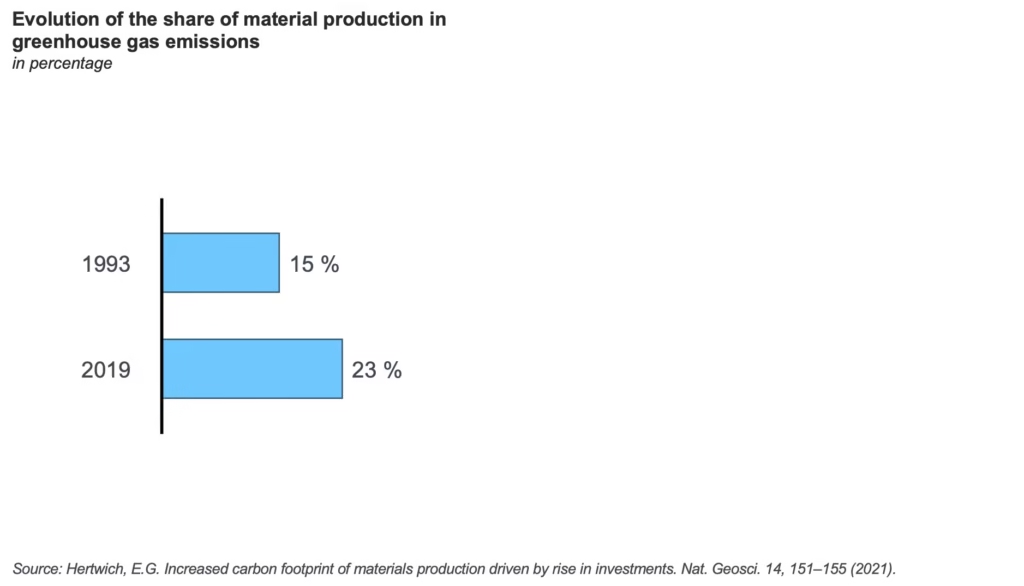

Material production is also responsible for more than 20% of greenhouse gas emissions

The materials industry, which includes companies that produce raw materials such as steel, aluminum, cement, and chemicals, is responsible for a significant share of global greenhouse gas emissions. For example, cement production alone accounts for 8% of global CO₂ emissions. In the case of ammonia, each ton produced emits 2.6 tons of CO₂, while for steel, the ratio is 1:2. Overall, the materials industry is responsible for 27% of global CO₂ emissions, including those related to energy use.

Yet existing sourcing strategies often fail to address and improve material efficiency.

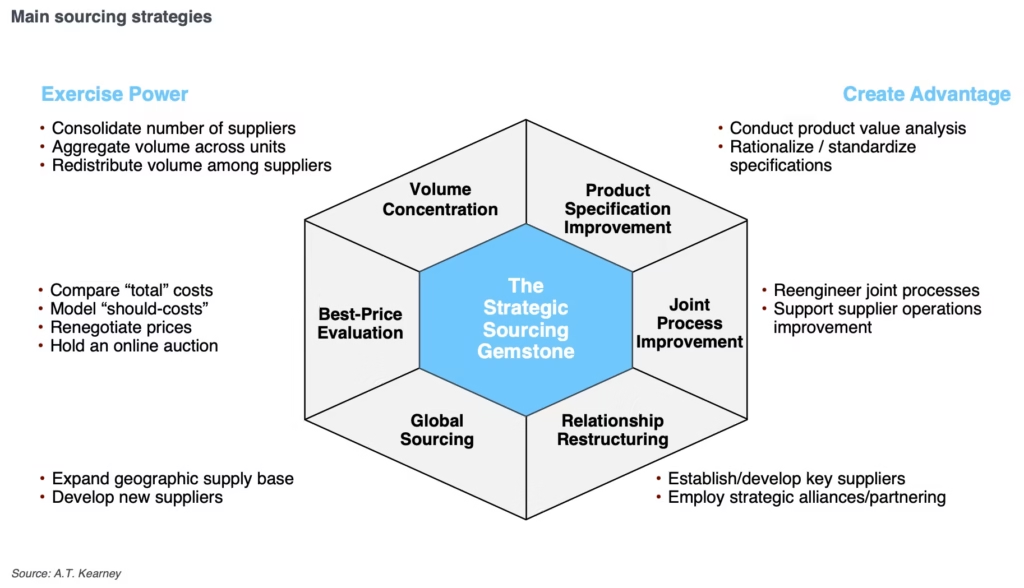

Purchasing strategies enable organizations to reduce costs and strengthen their supply chains. Approaches such as those outlined in A.T. Kearney’s Strategic Sourcing Gemstone have significantly improved labor productivity, particularly through sourcing from low-labor-cost countries. However, they have often failed to deliver similar gains in material productivity.

To improve material efficiency, purchasing departments should leverage circular sourcing strategies.

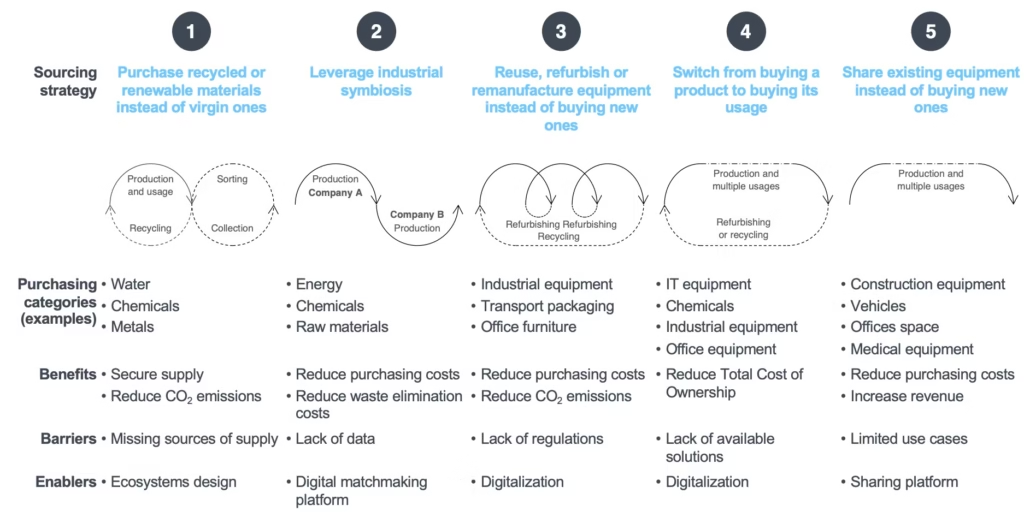

For a long time, buyers had few levers to improve material productivity. But this is no longer the case, thanks to circular economy purchasing strategies (see figure).

Purchasing recycled or renewable materials, rather than virgin materials, reduces costs and secures supply. For example, the GSK pharmaceutical plant in Montrose, UK, reduced its annual costs by €280,000 by replacing virgin methyl alcohol with recycled alcohol.

Leveraging industrial symbiosis allows the waste from one manufacturing process to be used as raw materials in another. Grey water from a production line can be reused for cleaning. Fruit pulps and peels, by-products of juice production, can be used to produce dietary fiber. Potato starch, a co-product of wallpaper glue manufacturing, is used in the production of bioplastics.

Purchasing reconditioned equipment, rather than new, also lowers costs. Many types of equipment, such as compressors, forklifts, and office furniture, can be reconditioned. Reconditioned equipment typically costs 20% to 40% less than new, with equivalent performance and warranty.

Buying the use of a product, rather than the product itself, can reduce total cost of ownership. For instance, the BASF plant in Münster, Germany, cut annual costs by €30,000 by opting for a compressed air service instead of purchasing a compressor. Renault reduced the total cost of ownership of cutting oil by nearly 20% by switching from purchasing the oil to purchasing its use as a service.

Finally, sharing existing equipment, rather than buying new, can lower procurement costs or generate additional revenue. For example, the company Floow2 helps hospitals share underutilized equipment (which has an average usage rate of only 42% for mobile equipment). The Yard Club platform has enabled 2,500 construction professionals to share construction machinery.

Buyers are not going to spend 80 percent of their time managing tenders and negotiating prices. They will be spending their time managing ecosystems of suppliers to implement these sourcing models. It’s going to require a lot of time to manage revenue generation and create a circular economy.

Our approach

To help our clients leverage circular procurement, we provide a set of services.

Training on circular sourcing

We deliver training on circular procurement. We leverage more than 100 examples and cases studies.

Workshop

We facilitate half-day workshops with category managers to identify circular sourcing opportunities and quick wins.

Circular sourcing opportunity study

For given purchasing categories, we help our clients identify, qualify and experiment relevant circular sourcing strategies.

Managing ecosystems of suppliers

We help procurement departments establishing and managing ecosystems of suppliers.

Cases studies

We reduced the annual waste management costs of a chemical plant by €0.5 million by using a digital platform to help our client find a buyer for their industrial waste.

We brought together over 100 GRDF suppliers, buyers, and specifiers for a day to design circular equipment. We used our circular economy card game to identify new opportunities.

For one day, we trained more than a hundred public buyers from the Pays de la Loire region on the challenges of circular procurement.

Our insights on circular sourcing

The potential of the circular economy for buyers

To improve material productivity, the purchasing function must rely on the circular economy.

Toward factories with no assets

Today, many factories are using energy service companies to improve their energy efficiency. Tomorrow, they will very likely buy pay-per-use services to improve their resource efficiency.

Pay-per-use chemicals

A growing number of chemical companies offer to sell not their chemicals, but the service those chemicals provide.

Connect with our circular economy consultants to know more