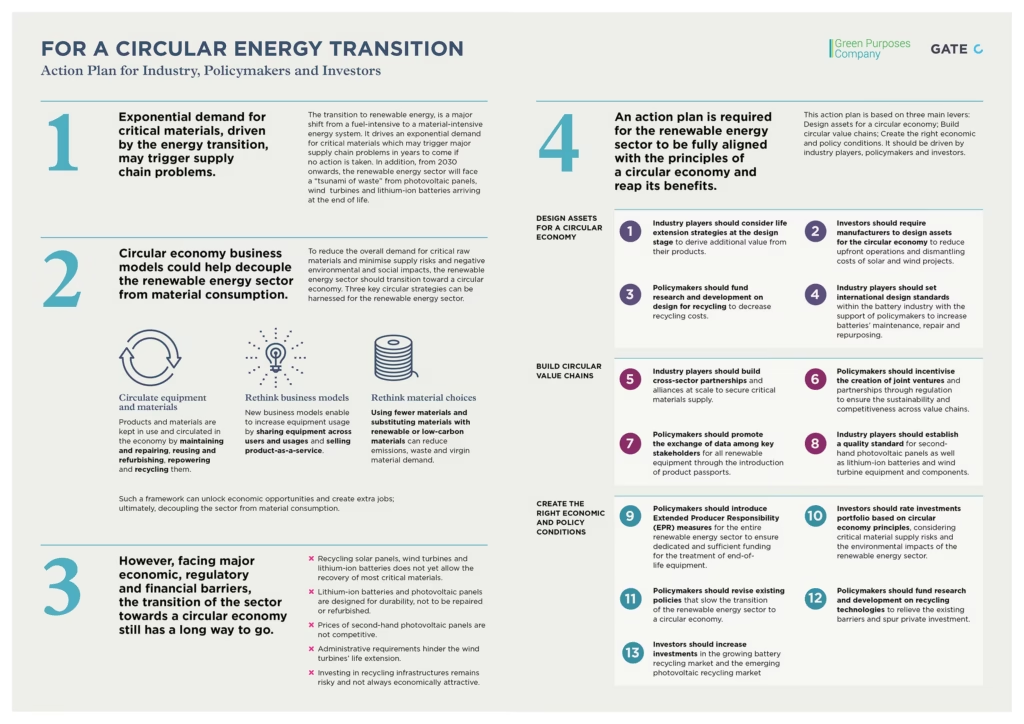

FOR A CIRCULAR ENERGY TRANSITION

Action Plan for Industry, Policymakers and Investors

Renewable energy: Circular economy transition of solar panels, wind turbines and batteries.

The original report is available here.

FOREWORD BY THE TRUSTEES OF THE GREEN PURPOSES COMPANY

The renewable energy sector has achieved impressive growth in recent years, generating some 40% of the UK’s electricity in 2022. There is also encouraging progress internationally as leading nations look to reach net zero. But this achievement is storing up problems. A proliferation of solar panels, wind turbines, batteries and other renewable technologies is placing pressure on the environment through the unsustainable extraction of raw materials and the absence of planning and design for end-of-life.

Moving to a circular economy model has the potential to address these risks. It is also a huge economic opportunity, ripe for innovation with new products and services. A circular model is also more efficient, driving down costs, often with fewer supply chain risks.

In our role as Trustees of the Green Purposes Company, we want to help scale up green investment by shining a light on market risks and opportunities. In our last report[1], we examined the emerging market in nature-based solutions. We think the circular economy is similarly vital. As such, we commissioned circular economy experts GATE C to review the evidence and make recommendations on what is needed to bring pace and scale to this market. The report makes recommendations for the key stakeholder groups of policymakers, investors and industry. It highlights the need for them to step up and bring about the changes required, taking encouragement from a growing number of examples of circular business models in this and adjacent sectors.

It is critical that in helping to address climate change the renewable energy sector does not inadvertently drive environmental problems elsewhere. At best, the sector is missing out on the growing economic opportunity and stronger supply chains that come from a circular economy, at worst, risks becoming complicit in ‘greenwashing’.

We hope you enjoy and act upon this important report.

Trevor Hutchings, Joan MacNaughton, Tushita Ranchan, Robin Teverson, Peter Young

Trustees

Green Purposes Company Limited

February 21st 2023

ACKNOWLEDGMENTS

This report has been commissioned by the Green Purpose Company and authored by Rémy Le Moigne (GATE C) and Lenaïc Gravis.

| The Green Purposes Company (GPC) is a not-for-profit company limited by guarantee.It has one primary function: to protect the green purposes of the Green Investment Bank (GIB), now trading as the Green Investment Group (GIG). It may also undertake supporting activities to promote the protection of the environment, should it choose to do so.The GPC’s current focus is solely on safeguarding the green mission of the GIG through its power as special shareholder in the GIB, and in maintaining a constructive relationship with GIG and its stakeholders.The GPC has public accountability and an implied responsibility to be open in its core functions. The GPC scrutinises the operation of the five green purposes. The GPC wishes the GIG business model to succeed, grow and act as an exemplar. | GATE C is a boutique management consulting specialised in the circular economy.It helps its clients to map the benefits and capture the value of the circular economy. GATE C works for global corporations from a wide range of industries. Leveraging circular economy business models, it helps them secure critical materials supply, minimise costs, reduce greenhouse gas emissions, generate additional circular revenues and comply with circular economy-related regulations. GATE C works for both governments and business associations.Since 2012, GATE C has driven more than 200 circular economy projects.For this report, GATE C project team was led by Rémy Le Moigne. Lenaïc Gravis is a circular economy expert, writer and editor. She has been working in the circular economy field for more than 10 years and has been shaping reports and books ranging from climate and biodiversity to fashion and plastics. Lenaïc provides expertise on circular economy narrative and framing to engage and mobilise actors towards this transformative change. |

| Green Purposes Company www.greenpurposescompany.com trustees@greenpurposescompany.com | GATE C www.gatecconsulting.com contact@gatecconsulting.com Lenaïc Gravis lenaic.gravis@gmail.com |

EXECUTIVE SUMMARY

CASE FOR CHANGE

The transition to renewable energy is critical in achieving the target set by the Paris Agreement on climate change

Rapid decarbonisation of the energy system is necessary to put the global economy on track to reach net-zero emissions by 2050 and therefore limit global warming to 1.5°C. To be on track for net-zero emissions, renewable energy capacity (see Box 1) will have to quadruple by 2030.[2] For solar photovoltaic, this will mean installing the equivalent of the world’s largest solar park every day by 2030.[3] The electric car fleet accounts for 5% of global car sales today and is expected to reach over 60% by the end of the decade.[4] In parallel, battery storage will need to scale up while global electricity networks, which have taken over 130 years to build, will have to more than double in total length by 2040 and increase by another 25% by 2050.[5] Such a transition represents a real challenge, and its feasibility will depend on the availability and affordability of the necessary minerals and metals.

Box 1: Main renewable energy infrastructures and their main mineral commodities

| Solar panels | Solar panels convert sunlight into electricity.Crystalline polysilicon is the dominant technology for PV modules, with over 95% market share.[6] Polysilicon cells (photovoltaic cells or PV cells) convert solar energy into electric energy by the photovoltaic effect. Multiple cells and silver wires are sealed together in a protective polymer laminate positioned between a front glass plate and a back sheet to form a solar module. These modules are assembled into a solar panel and framed with aluminium. An inverter converts the generated direct current into an alternating current that can be used by the electricity grid. |

| Wind turbines | Wind turbines convert wind energy into electricity.Rotor blades, made from fiberglass, convert the kinetic energy of the flowing air mass into mechanical rotation energy. A gearbox and a permanent magnet generator, protected by a nacelle, convert mechanical energy from the rotor into electric energy. The generator uses rare earth elements such as boron, dysprosium, neodymium and praseodymium. The nacelle is mounted on a steel tower. |

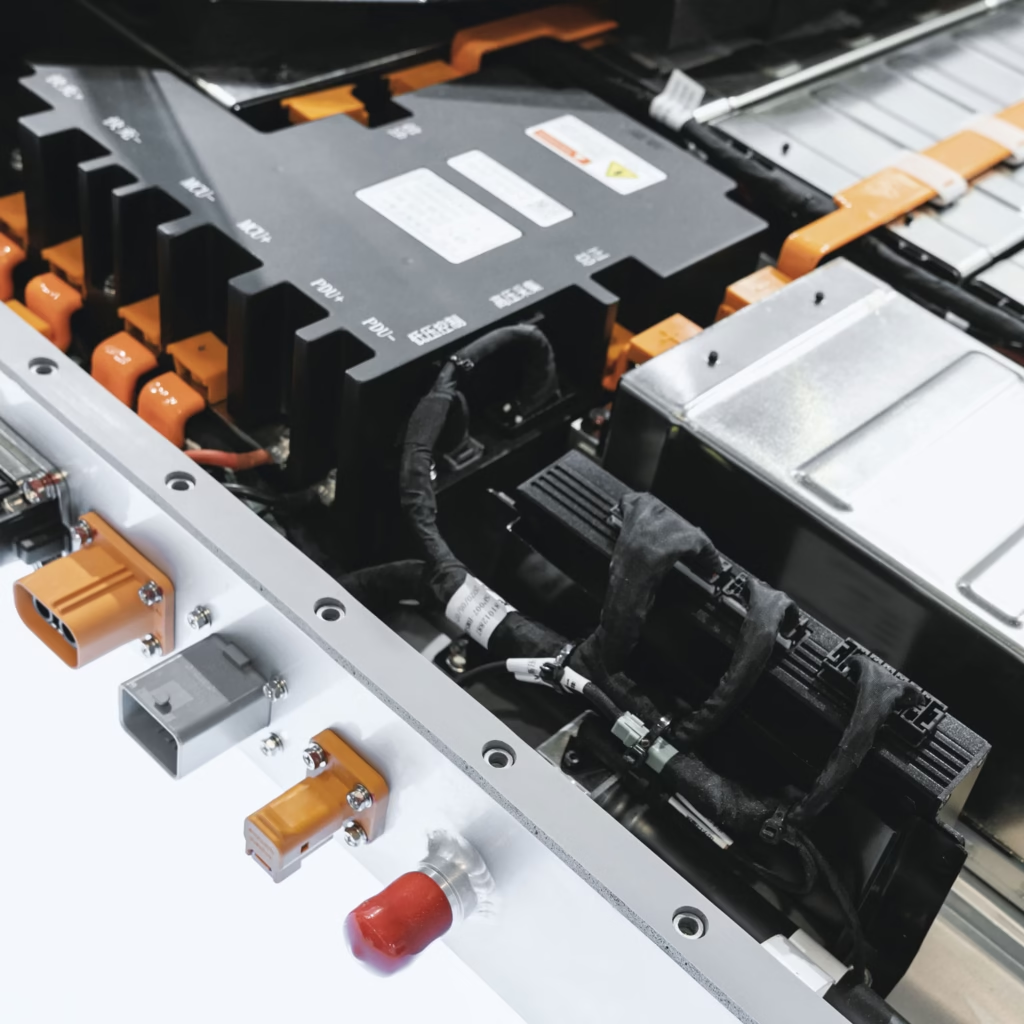

| Lithium-ion battery | Batteries store electric energy.A battery cell consists of a metal cathode (made of lithium along with a mix of other elements, including cobalt, nickel, manganese, and iron), a graphite anode, a separator, and a liquid electrolyte. The electrolyte chemistry composition varies but is typically made of lithium salt. An electric current is generated as lithium ions flow from the anode to the cathode.While a single battery cell is enough to power a phone, thousands of cells are required to run an electric vehicle. Cells must then be bundled together into modules and modules into a pack. |

| Fuel cells & electrolysers | Fuel cells convert the chemical energy of hydrogen into electricity.A fuel cell works like a battery but does not run down or need recharging. It produces electricity and heat when fuel (hydrogen) is supplied. Fuel cell consists of a polymerelectrolyte membrane (PEM) sandwiched between two electrodes, made of platinumparticles uniformly supported on carbon particles.To increase the amount of electricity generated, individual fuel cells are combined in a fuel cell stack.Electrolysers convert electric energy and water into hydrogen. |

The transition to renewable energy is a major shift from a fuel-intensive to a material-intensive energy system. Although photovoltaic plants and wind farms do not need fuel to operate, they require much more material to build and operate than fossil fuel plants. An onshore wind plant requires nine times more mineral resources than a gas-fired plant of the same capacity.[7],[8] Mineral commodities are vital to renewable infrastructure and are considered as critical materials to support the transition (see Table 1). Lithium, cobalt, and nickel are essential to produce high-performing batteries.[9] Rare earth elements are needed to make powerful magnets used for wind turbines. Hydrogen electrolysers and fuel cells require nickel or platinum group metals. To meet the demand of the renewable energy sector, the mineral supply would have to increase at least four-fold by 2040.[10]

Table 1: Critical mineral needs for clean energy technologies[11]

| Solar | Wind | Battery storage | Hydrogen | Electricity networks | |

| Copper | ●●● | ●●● | ●●● | ● | ●●● |

| Cobalt | ● | ● | ●●● | ● | ● |

| Nickel | ● | ●● | ●●● | ●●● | ● |

| Lithium | ● | ● | ●●● | ● | ● |

| Rare Earth Elements | ● | ●●● | ●●● | ●● | ● |

| Chromium | ● | ●● | ● | ● | ● |

| Zinc | ● | ●●● | ● | ● | ● |

| Platinum Group Metals | ● | ●● | ● | ●●● | ● |

| Aluminium | ●●● | ● | ●●● | ●● | ●●● |

Number of dots indicates the relative importance of minerals for a particular clean energy technology (●●● = high; ●● = moderate; ● = low).

In addition to the critical materials required for the energy transition, demand for materials such as steel and cement needed for infrastructure could also increase. But if steel, for example, is widely used across a broad range of renewable energy technologies, the energy sector is not a major driver of global growth in steel demand.[12]

Exponential demand for critical materials, driven by the energy transition, may trigger supply chain problems

The supply of critical materials has become of primary geopolitical importance and raises government concerns over supply disruption. The production of many critical minerals today is more geographically concentrated than that of oil or natural gas. For example, China produces more than 90% of all globally used rare earth metals and has unique expertise in rare earth processing technologies. At a lower, but still important, concentration level, cobalt and nickel are produced by only a handful of regions. The Democratic Republic of the Congo produces 70% of the global production of cobalt and Indonesia is the largest nickel producer (30%), followed by the Philippines (13%), and Russia (11%).[13]These concentrations of production increase the supply risks linked to physical disruptions, trade restrictions, or other political changes that may occur in these countries. For example, the prices of aluminium and nickel, for which Russia is a key supplier, reached their 10-year high in February 2022, leading to concerns about entering a new commodity supercycle. With the strategic implications of new resource dependencies, governments will need to keep long-term geopolitical issues in mind.

As demand increases, mining efforts increase, but so do the challenges. Mining is a time- and capital-intensive sector. Thus, time lags are significant. On average, it takes more than 16 years to move a mining project from discovery to first ore production. These long lead times do not necessarily offer the answer to price volatility and supply shortages. In addition, some particularly polluting mines often face considerable local opposition, and considering billions in investments, mining companies are wary of the risk in the light of price fluctuations.

The cost of electricity from solar and wind power has fallen but commodity prices continue to rise and could eventually limit demand growth. Between 2010 and 2020, the cost of renewable power generation worldwide has fallen sharply. The global weighted average levelized cost of electricity (LCOE)[14] of newly commissioned utility-scale solar photovoltaic projects declined by 88% over that period, while that of onshore wind fell by 68%, and offshore wind by 60%.[15] However, past falls in price have masked significant increases in commodity prices. These increases are likely to continue and impact transition costs in the future.

Between January and May 2022, the energy produced by solar photovoltaic and wind generation alone has likely avoided approximately $50 billion in fossil fuel imports in Europe.[16] Without renewables, the fossil fuel price crisis experienced in 2022 would have been much worse for consumers, economies, and the environment. But rising raw material prices could reduce these gains since they now account for a significant share of the total cost of clean energy technologies. For example, cathode materials – including lithium, nickel, cobalt, and manganese – which accounted for less than 5% of lithium-ion battery costs in the middle of the last decade, now represent over 20% of the current price.[17] In recent months and years, due to a combination of rising demand and disrupted supply chains, prices have risen for neodymium, cobalt, nickel, and lithium, and in some cases to levels that have not been seen before. This will have implications for the transition, for example it could delay electric vehicles from becoming as affordable as conventional cars. It is not clear what the price dynamics will be going forward but some concerns have been raised that it could have detrimental implications for the transition.

The “Take-Make-Waste” model of the renewable energy sector is wasteful and polluting

Most of the value in critical materials is lost at their end of life. In the United States, the cost of solar photovoltaic module recycling is often outweighed by cheaper, more accessible disposal options. As a result, less than 10% of panels are recycled,[18] and when they are, only aluminium and copper are recycled, but not silver and silicon. However, while silver and silicon represent less than 0,08% and 4% respectively of the mass of a silicon photovoltaic cell, they represent 9-23% and 35-45% of their value.[19] Many lithium-ion battery recycling units, mostly large pyrometallurgy facilities, recover cobalt, nickel, and copper, but not lithium and aluminium which are burned. To date, there is no industrial recycling plant to recover rare earth elements from wind turbine permanent magnets. In addition, the collection of lithium-ion batteries is underperforming. For example, in the United States, lithium-ion batteries are only collected and recycled at a rate of less than 5%.[20]

The renewable energy sector is facing a “tsunami of waste”. Global photovoltaic module waste is projected to reach a cumulative value of 60 to 78 million tonnes by 2050.[21] This projection could be even higher if customers choose to trade their existing panels for newer, cheaper, more efficient models instead of keeping their panels in place for the entirety of their 30-year life cycle.[22] The waste from turbine blades will reach a cumulative value of 43 million tonnes by 2050.[23] The amount of spent electric vehicles and storage batteries reaching the end of their first life is expected to surge after 2030 and to reach 1.300 gigawatt hours by 2040.[24] When all the electric cars sold in 2019 reach the end of their lifetime, this would result in 500,000 tonnes of unprocessed battery pack waste.[25] As landfill costs rise, the cost of disposal of turbine blades and photovoltaic panels is likely to soar.

The transition to renewable energy is necessary and urgent, and presents real economic opportunities, but the sector faces many challenges. Although they are referred to as “green energy”, renewables have a significant impact on the environment and their future growth will have to follow a just and sustainable pathway.

THE CIRCULAR ECONOMY CAN PROVIDE NEW OPPORTUNITIES FOR THE RENEWABLE ENERGY SECTOR

Circular economy business models could help decouple the renewable energy sector from material consumption

To reduce the overall demand for critical raw materials and minimise supply risks and negative environmental and social impacts, the renewable energy sector should transition toward a circular economy (see Box 2). The circular economy framework ensures that renewable energy equipment, components, and materials are maintained at their maximum value during use and re-enter the economy after use, never ending up as waste.

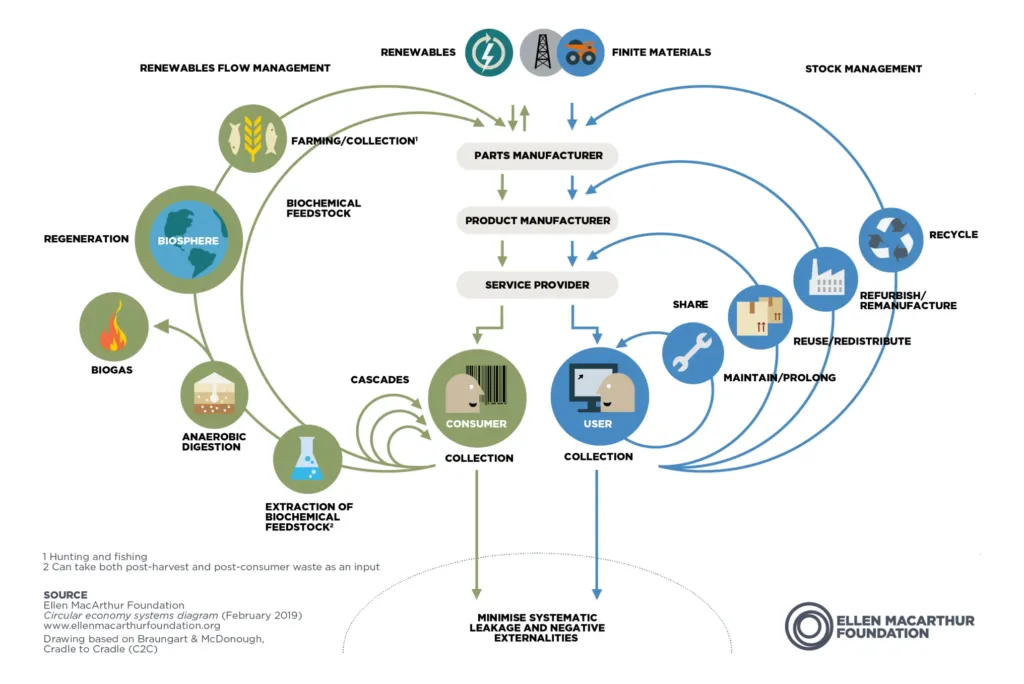

Box 2: The circular economy concept and principles[26]

In today’s economy, materials are taken from the earth and turned into products which, after a short life cycle, are thrown away as waste. This linear process is wasteful and polluting. By contrast, in a circular economy, products and materials are kept in use and circulated in the economy or returned to the environment to support ecosystem health (see Figure 1).

The circular economy is an approach that considers the whole life cycle of products, materials and systems, from the design phase to the use phase, up to their end of life. Products and materials are kept at their highest value during use and re-enter the economy after use through strategies such as repair, reuse, remanufacturing, recycling, etc. It is a holistic and long-term approach, taking into account environmental and social impacts and pressures on resources and biodiversity. A circular economy gradually decouples economic activity from the consumption of finite resources.

The circular economy is based on three principles, driven by design: Eliminate waste and pollution; Circulate products and materials; Regenerate nature.

Figure 1: The butterfly diagram

The transition of the renewable energy sector to a circular economy is essential to ensure the reliability and resilience of critical materials supply. The circular economy can also help reduce carbon emissions and biodiversity loss, and become a source of new value creation and jobs.

Circulate equipment and materials

Maintain and repair

Maintenance and repair allow renewable energy equipment to operate for longer. It is a cost-effective option as it keeps the existing infrastructure in place. By extending the life span and sustaining the performance and availability of renewable energy infrastructure, the demand for raw materials, as well as the greenhouse gas emissions and biodiversity impacts associated with material extraction are reduced. Maintenance and repair also help prevent large amounts of waste from ending up in landfill.

To fully tap the potential of wind energy, wind turbines need to be maintained throughout their life cycle. Many moving parts, such as the blades and gearbox, are subject to wear. To sustain high availability, these parts must be maintained when they fail (corrective maintenance), and on a regular schedule (preventive maintenance) or, ideally, according to their condition (condition-based maintenance). Wind turbine condition data, such as vibration or speed, can be collected by sensors and analysed by predictive algorithms that detect failure patterns by comparing real-time data with pre-identified failure patterns. Maintenance is either managed by the turbine manufacturer during the warranty stage, by an in-house service team for owners of big fleets or by independent service providers. For example, turbine manufacturer Siemens Gamesa installs inside each turbine more than 300 sensors that continuously transmit over 200 gigabytes of data per day to the company’s remote diagnostic centre in Brande, Denmark. Advanced analytics and human monitoring convert the raw data into valuable insights, allowing the prediction and prevention of unscheduled downtime.[27]

Exposed to severe weather, and damaged by events such as hailstorms and lightning strikes, photovoltaic panels need to be repaired and maintained as well. According to a recent study, if maintenance was carried out at regular intervals, the photovoltaic panels installed today could be operated for 20-25 years longer, while maintaining a high efficiency to produce as much energy as possible.[28]

Reuse and refurbish

Solar and wind renewable energy equipment has been designed to match the duration of farm lease contracts but can operate for many more years. Extending the life of the equipment by reusing or refurbishing it preserves the embedded material, labour, energy, and capital, and avoids the associated externalities, such as greenhouse gas emissions and water consumption.

Offshore wind turbines have been designed to last 20 years, but they can operate for much longer, improving cost savings and reliability. The lifetime of a wind turbine can be extended by exchanging or upgrading some of the key components, such as the generator, while the overall external layout of the turbine remains unchanged. Siemens Gamesa offers a programme to extend the life of its ageing wind turbines by 10 years. However, lifetime extension needs to be carefully evaluated, considering the level of corrosion and fatigue damage to offshore structures.

Remanufacturing used components to their original manufacturer specifications helps extend the wind turbine’s residual life and recover economic value. For example, the US company Renew remanufactures wind turbine gearboxes. Each gearbox is completely disassembled into components and parts, which are then either replaced or reused. The components are reassembled to form a “like new” gearbox. In the UK, Boythorpe sells remanufactured wind turbines for half the price of new ones. According to the turbine manufacturer Vestas, remanufacturing turbines saves up to 70% of materials and on average 45% of CO2 emissions compared to a new part, even after accounting for transportation to and from a repair and remanufacturing facility.

Wind turbine parts can also be reused as spare parts in another wind turbine. A few companies such as Mywindparts in France, Spares in Motion in the Netherlands and Repowering Solutions in Spain sell used wind turbine parts.

With life extension and remanufacturing of offshore wind turbine operations, the UK could create 5,000 new jobs in addition to the current projection of 60,000 jobs within the offshore wind sector by 2030, according to an estimate by Leeds University.[29]

Reusing photovoltaic panels is more cost-effective than decommissioning them. The electricity produced by photovoltaic panels decreases at a rate of 0.5% per year. Therefore, at the end of their lifetime, estimated at 25–30 years, the panels still produce more than 80% of the electricity originally produced. And, when they retain only 70% of their original capacity, the panels can have a second life in less demanding applications, such as for affordable housing. A second-hand market for solar panels is emerging. It counts around 15 companies worldwide, mostly in Germany and China, trading an estimated 1 gigawatt per year, of which around 0.3 gigawatt per year originates from Europe. Some digital marketplaces, such as SecondSol and pvXchange, buy and sell used solar panels. Reusing panels would reduce the number of panels sent to landfill. This is important as landfilling photovoltaic panels that contain valuable materials will lead to a significant cumulated economic loss of up to €540 million by 2030, not to mention environmental impacts.[30] In addition, sending operational solar panels that retain 70–80% of their original capacity to landfill is not an option knowing that 770 million people live without access to electricity.

Lithium-ion batteries can have an extended first life, and then a second life. The life of a battery can be extended by replacing or exchanging damaged cells throughout its service life or at the end of its life. Usually, when a battery reaches its end of life, only a few cells are degraded. Replacing a relatively small number of cells can restore the batteries to a near “new” state.[31] For example, for its Leaf car Nissan mass-produces refurbished lithium-Ion batteries, specifically designed with very small modules and bolted connections. When the battery no longer meets the demands of automotive use, it can have a second life in applications that are less demanding in terms of energy density and available power. These include large-scale electricity storage for utility markets and compact mobile storage applications, such as in forklifts. Battery refurbishing can require separating and rebuilding the modules or even single cells for an entirely different product and application from the originally designed one. For example, London-based Powervault manufactures storage electricity systems using second-life lithium-ion cells from electric vehicles.

At the end of a fuel cell’s lifespan, the membrane electrode assembly (MEA) wears out. Refurbishing can extend the life of the fuel cell by replacing the core fuel cell membranes. The bipolar plates, a component of the membrane, can be reused in a new stack when made from carbon. Fuel cell manufacturer Ballard refurbishes used fuel cells and returns them to their original users.

Repower

Repowering existing wind farm infrastructure is usually more cost-effective than commissioning new farms.Installing new drivetrains while keeping the towers, foundations, and electrical grid installation in place allows existing wind power sites to increase energy production, reduce machine loads, enhance grid service capabilities, and improve reliability at a lower cost. According to a study comparing different end-of-life scenarios, repowering yields the highest positive cash flows, compared to life extension and dismantling, allowing developers to maximise electricity production with low overall extra cost.[32] However, unlike turbine life extension, repowering requires that most of the components, such as drivetrains and rotors, are replaced. Ideally, these components can be sold as spare parts or reused in other applications. According to the Momentum Group – which recommissioned five refurbished turbines at the Bockstigen wind farm in Sweden – replacing the nacelles, blades, and control systems with components sourced from refurbished turbines while reusing the original turbine towers, foundations, and transmission cables, has extended the life of the turbines by at least another 15 years and more than double the expected annual electricity generation from 5,000 megawatt-hours to 11,000 megawatt-hours.

Recycle

If equipment cannot be kept in use at its end of life, the materials and components can re-enter the economy through recycling. Material recycling increases the recovery of valuable constituents, ensuring a secure supply of critical raw materials. Even though material recovery is preferable to disposal in end-of-life scenarios, it should remain the last strategic circular option as the embedded value of the equipment (time and energy invested in making it) is lost.

When a photovoltaic panel cannot be reused, the materials within it still can. Photovoltaic panels are mostly made of glass but they also contain silver, aluminium, polysilicon, and copper. If silver accounts for less than 0.08% of the total weight, it makes up more than 9% of the material value.[33] Polysilicon has a relatively high resale price because it is obtained through an energy-intensive process to achieve the concentration needed for solar panel efficiency. ROSI Solar, a newly created company in Grenoble, France, is building a factory capable of recycling 3,000 tonnes of solar panels per year using a delamination technique. Ultimately, recycling should relieve the pressure on critical material supply. By 2050, the amount of raw materials technically recoverable from spent photovoltaic panels could produce about 2 billion new panels, and the recovered value of these materials is expected to exceed $15 billion.[34]

The concentration of critical metals in a spent lithium-ion battery is much higher than in ores. If one tonne of ore contains about 0.3% of cobalt, one tonne of spent lithium-ion batteries contains between 7% and 20% of cobalt. Similarly, one tonne of ore contains 0.4% of lithium while one tonne of spent batteries contains more than 3% of lithium.[35] Therefore, batteries should be recycled to reduce their high dependence on virgin materials. By 2040 secondary production from recycled minerals could account for up to 12% of total supply requirements for cobalt, around 7% for nickel, and 5% for lithium and copper.[36] In 2021, the total value that can be recovered from batteries was over $7,000 per tonne of battery waste, based on the metal resource pricing and assuming 90% recovery efficiency.[37]

Rethink business models

By rethinking business models from ownership to Product-as-a-Service (PaaS), or equipment-as-a-service, manufacturers remain in control of their equipment throughout its life cycle from refurbishing to recycling, and thereby secure their supply of critical raw materials. This also allows a greater utilisation rate across multiple users or applications.

Shared across users, vehicles and usages, lithium-ion batteries can reach a high utilisation rate. Traditional lead-acid batteries have a low utilisation rate as they are mostly used to start the engine of cars that remain unused 95% of the time. To achieve greater reuse of lithium-ion batteries, various solutions exist. Shared mobility solutions, such as car-sharing and vehicle fleet management, allow a single electric vehicle to be shared across multiple users. Battery swapping solutions allow electric vehicle users to replace low-charge batteries with fully charged ones quickly. Today, battery-swapping is mainly taking place in China where six companies plan to build 26,000 battery-swapping stations by 2025. Vehicle-to-grid (V2G) solutions allow cars to return part of the electricity stored in their batteries to the grid to alleviate the intermittent availability of renewable energy sources. V2G solutions could lower the costs for electric vehicle charging infrastructure by up to 90% and, in 2030, could cover 65% of the demand for battery storage powering grids globally.[38] The cost reduction stems from using batteries more intensively through V2G and shared mobility, but also repurposing, recycling, and technological improvement – resulting in a reduction of battery pack costs from $90 per kWh to $70 per kWh in 2030.[39]

A lithium-ion battery can be sold as a product but also as a service. For example, Renault Group leases the batteries of its electric vehicles and owns about 180,000 batteries – the largest stock of batteries in the world.[40]Sandvik sells Battery-as-a-Service for electric trucks by retaining ownership of the battery packs, chargers, spare parts, and any needed maintenance. In addition to reducing the upfront cost of an electric vehicle, Battery-as-a-Service incentivises durability and offers recycling opportunities as well as continued access to supplies of raw materials required to manufacture batteries.

Rethink material choices

Using fewer materials and substituting materials with renewable or low-carbon materials, such as secondary materials, offers the opportunity to reduce emissions, eliminate waste, and reduce virgin material input.

Use fewer materials

Designing equipment using fewer materials in the first place can help reduce emissions and waste. In 2014, GE built a lattice tower that could be shipped disassembled on standard trucks and ocean vessels, and then assembled directly at the wind farm location for ease of logistics. The tower improved serviceability thanks to increased space down-tower, a maintenance-free bolting system, and custom fixtures for efficient installation and dismantling. The lattice tower was assembled at wind farm locations and then wrapped in an architectural fabric to provide familiar solid structural aesthetics. Compared to tubular steel towers, lattice towers require much fewer materials, they are 40% lighter and have construction costs reduced by 15%.[41] Although they are not yet popular, in the future they would not only use less material but also allow the dismantling and reuse of wind towers. Similarly, for photovoltaic panels, 40-50% reductions in the use of silver and silicon in solar cells have been achieved over the past decade which has contributed to a substantial increase in their deployment.[42]

Substitute for low-carbon, circular materials

Substituting emissions-intensive materials such as steel and concrete with renewable materials offer environmental and economic benefits. Using wood, for example, presents the opportunity to bind carbon in products so that they can act as a carbon sink. Modvion AB has designed a wood-made modular wind turbine tower, which can go well beyond 150 metres in height and support a 320-tonne nacelle and turbine. Modvion has stated that a tower made of wood will emit 90% fewer emissions during its lifecycle than a steel tower. At its end of life, the wooden tower can be beneficially reused in other applications, such as high-strength beams for the construction industry and would not end up as waste.[43] In the electric vehicle sector, a lot of manufacturers have started to switch from lithium-ion batteries to lithium-iron-phosphate batteries. These batteries without cobalt use less polluting and abundant components. Similarly, substituting silicon with perovskite could make solar cells cheaper and easier to manufacture.

The use of recycled materials reduces not only the reliance on raw materials but also greenhouse gas emissions. Battery-recycling start-up Ascend Elements has designed a technology that recovers the material from spent battery cathodes to manufacture new cathodes. This technology, called direct recycling, separates out the cathode material from individual battery cells, and rehabilitates the mixtures of chemicals inside it, including by adding back lithium that has been depleted from use, instead of extracting individual metals from the mix. According to Ascend Elements, recycled cathode material lowers costs by up to 50% and decreases carbon emissions by up to 90% compared to virgin cathode material.[44]

In most countries, the transition of the renewable energy sector towards a circular economy still has a long way to go. For example, according to analysis of over 3,000 publications and a study led by National Renewable Energy Laboratory, neither photovoltaic nor lithium-ion batteries industries have yet reached their circular economy transition, however, both sectors are on a path towards increased circularity.[45]

To fully align the renewable energy sector with the principles of the circular economy and reap its benefits, three key levers are needed: Design assets for a circular economy; Build circular value chains; Create the right economic and policy conditions.

DESIGN ASSETS FOR A CIRCULAR ECONOMY

Plan for life extension

Lithium-ion batteries are designed for performance and mass production with little regard for life extension strategies from the outset – making repair, refurbishment, and remanufacturing difficult and expensive. Whereas early electric vehicle batteries were produced in small volumes using easily disassembled bolted connections, today’s welded batteries require costly manual pack removal and disassembly, module removal, and cell separation for repair. Toyota and Johnson Controls have filed patents on a remanufacturing process for batteries, and Tesla has announced that it will remanufacture the Model 3 battery pack at the module level. But currently, there are no industrial applications for cell-level remanufacturing of batteries using lithium-ion and welded cell chemistry.[46]

Photovoltaic panels are designed for durability, not to be repaired. The design of solar panels has not changed much over the years. Most panels consist of silicon crystalline cells and silver wires sealed in layers of polymers and protected between a front and back glass plate, surrounded by an aluminium frame. While this robust, weatherproof design allows the panels to function for decades, it also makes them difficult to disassemble and repair. Repairs are usually limited to replacing a few parts such as the frame, the junction box, a diode, a plug, or a socket.[47]Manufacturers do not retain ownership of the components and are not expected to take care of them at their end of life. Therefore, designing components for longevity and reuse is not a priority or a requirement. In view of the staggering amount of waste expected by 2030–50, a better compromise between durability and repairability will have to be found.

Wind turbines designed without consideration for modularity hinder repair and upgrade. For example, the wind turbine manufacturer Vestas is working on a modular nacelle divided into a main nacelle and one or more side compartments. The side-compartments typically house many different types of technology and relevant applications. With a simple snap-in system, the modular pod facilitates intelligent maintenance solutions and opens opportunities for upgrades and innovation throughout the life of the operational asset.

Recommended action 1: Industry players should consider life extension strategies at the design stage to derive additional value from their products.

Some companies are already doing it, for example, the UK company Aceleron has designed a battery with no fixed, or permanently bonded components that can be easily maintained and upgraded, reducing costs, energy and raw materials extraction related to the production of new batteries. Energy company Enel is working on solar panel modularity, disassembly, standardisation, and material choices to extend the panels’ useful life.[48] Nissan designs its batteries with second-life applications in mind.

Investors are in a powerful position to drive adoption of circular economy principles by businesses because they are involved at the inception and design stage of projects, and they can fund enterprises driving both the demand and supply side of recovery processes. In addition, they can benefit from reduced risk and cost of capital by engaging with the whole supply chain rather than treating material costs and availability as external risks.

Recommended action 2: Investors should require manufacturers to design assets for the circular economy to reduce upfront operations and dismantling costs of solar and wind projects.

By designing photovoltaic panels and wind turbines for repair, remanufacturing and recycling, costs will be reduced. For example, if the components are designed to be disassembled, and marketed in a Product-as-a-Service (PaaS) model, the initial costs will be lower. Additional value can also be captured through reuse and recycling. When evaluating their investments, investors should carry out due diligence to assess whether the assets have been designed for a circular economy. Examples of questions that could be asked in this assessment are in the table below (see Box 3).

Box 3: Assess whether equipment has been designed for the circular economy

| Upfront costs | Can the equipment or some of its components be delivered through a Product-as-a-Service model rather than bought?What is the percentage of sales from circular products and services? |

| Maintenance and operation costs | Has the equipment been designed for modularity?Has the equipment and its components been designed for disassembly?For how long will spare parts be available, at the end of the warranty stage?Are certified used parts and components available?Which components are commonly refurbished or remanufactured?How many repair or refurbishing centres are in operation? What information on the equipment (composition, usage, etc.) will be provided at the end of the warranty stage? |

| Dismantling costs | Of the nine Design for Recycling guidelines published by the International Energy Agency, how many have been followed for the design of the equipment?[49]What percentage of critical materials, in weight, can be effectively recovered at the equipment’s end of life?What percentage of material, in weight, is recyclable technically, in practice and at scale?Can parts and components, with a longer life span than the equipment itself, be reused in other equipment? |

Design for recycling

Equipment that is not designed for recycling results in the loss of valuable materials at its end of life. While closing the material loops helps reduce raw material supply risks, the volume of recovered metals that are used in battery manufacturing is currently low. Within the European Union, only 12% of aluminium, 22% of cobalt, 8% of manganese, and 16% of nickel used is recycled.[50] The current design of solar panels does not allow all materials to be recovered without loss of quality, as the laminated encapsulant on the glass of many photovoltaic panels is not designed to be removed. Wind turbine blades are designed to be easy to manufacture, lightweight, cost-effective, and with a life span of 25–30 years, but with no consideration for their recyclability. As a result, when wind turbine blades reach their end-of-service lives, they usually end up in landfill.

Recovery of critical materials during recycling should be a priority. Currently, it is not. Rare-earth elements from permanent magnets used by wind turbines are not recovered at scale. Most solar panel recycling processes recover aluminium and copper but not silver and silicon that make respectively less than 0.1% and 4% of the mass of a silicon photovoltaic cell, but 9-23% and 35-45% of its value.[51] The pyrometallurgical process used to recycle lithium-ion batteries recovers cobalt and nickel but loses lithium and manganese.

Recommended action 3: Policymakers should fund research and development on design for recycling to decrease recycling costs.

In the United States, the Department of Energy’s battery recycling R&D centre explores design improvements than can enable easier disassembly and material separation of lithium-ion batteries to decrease recycling costs. In the Netherlands, research organisation TNO has developed an encapsulation technology that allows the different materials to be easily separated in a non-destructive way. This technology enables to design panels for recycling without affecting their life span.

Set out international design standards

The lack of standards makes batteries costly to repair and refurbish. Battery packs currently on the market vary in size, electrode chemistry, and format (cylindrical, prismatic, and pouch), and are designed to be best suited to a given electric vehicle model. By 2025 up to 250 new models will exist, featuring batteries from more than 15 manufacturers.[52] While battery production is fully automated, the method of disassembly, which is different for each pack design, remains entirely manual. Disassembly requires costly manual pack and module removal, pack disassembly, and cell separation.

International convention bodies, regulators, and manufacturers should work together to foster product design and technical development to facilitate disassembly for repurposing, repair and recycling.[53] For example, the Global Battery Alliance, a public-private partnership of 80 businesses, governments and non-governmental organisations, aim to establish a circular battery value chain and enable productive and safe second-life use by ensuring the recovery of battery materials. At a national level, China released the first global automotive industry standards for battery-swapping technology last year. The government of India announced plans to introduce policy and interoperability standards with the aim of building and improving the efficiency of the battery-swapping ecosystem. The lithium-ion battery industry should probably learn from the lead-acid battery example (see Box 4).

Box 4: Learning from lead-acid battery standards

Dimensions of lead-acid batteries are defined by industry standards. There are few variations in cell chemistries and a limited number of different materials that require sorting. Lead-acid battery recycling is technically easy and inexpensive. In developed economies, lead-acid batteries are managed almost entirely in closed loop. More than 97% of lead-acid batteries are recycled in the US and Europe, and over 75% of the lead used in new lead-acid batteries comes from recycled batteries.[54]

Recommended action 4: Industry players should set international design standards within the battery industry with the support of policymakers to increase batteries’ maintenance, repair and repurposing.

BUILD CIRCULAR VALUE CHAINS

Build ecosystems

In the wind industry, offshore wind companies operate in silos along the farm life cycles, paying little attention to disassembly and recycling at end of use, while timely communication between decommissioning and recycling is missing.[55] In the industry, partnerships do exist but are mainly focused on blade recycling. However, three business associations from the wind and chemical industries – WindEurope, the European Chemical Industry Council, and the European Composites Industry Association – have created a cross-sector platform to advance new approaches to the recycling of wind turbine blades. Siemens Gamesa has partnered with Epoxy resin manufacturer Aditya Birla Advanced Materials to produce recyclable wind turbine blades. The energy company Iberdrola and the waste management company FCC Ámbito have partnered to build a wind turbine blade plant in Spain.

Due to design issues and the difficulty of recycling solar panels, collaborations within the solar industry are also still scarce. ITOCHU Corporation aims to establish a recycling chain for solar panels by combining photovoltaic power generation-related business know-how and networks developed by its team with ROSI’s advanced and cost-effective recycling technologies.[56] Supported by the China Ministry of Industry and Information Technology, the PV Committee of China Green Supply Chain Alliance (China ECOPV Alliance) is a cooperation and communication platform committed to the development and research of ‘green manufacturing’ (eco-design and eco-label), resource efficiency (reliability and recycling), and low-carbon development in the photovoltaic field comprising 52 photovoltaic company members.

Recommended action 5: Industry players should build cross-sector partnerships and alliances at scale to secure critical materials supply.

For battery and electric vehicle manufacturers, recyclers, metal processors, and chemical companies, collaboration is key to bridging capability gaps in technological innovation, material reintegration into the battery value chain, and collection and waste management. For this reason, multiple partnerships and alliances have been created. For example, the recycling company Redwood has partnered with Toyota to collect, refurbish, and recycle batteries and battery materials destined for the automaker’s upcoming battery plant in North Carolina. In Norway, Morrow Batteries, the recycling company Li-Cycle and the energy storage systems provider ECO STOR have formed a joint venture to establish battery recycling facilities.

Recommended action 6: Policymakers should incentivise the creation of joint ventures and partnerships through regulation to ensure the sustainability and competitiveness across value chains.

The European Commission proposed a regulation to recycle 65% of battery weight by 2025, with a target recovery rate of 70% for lithium and 95% for nickel, cobalt, and copper by 2030.[57] Since 2017, the regulation triggered the creation of 24 alliances for the recycling of lithium-ion batteries in Europe.[58] In China, the “Interim Measures for the Management of the Recycling and Utilization of New Energy Vehicle Power Batteries” require that battery manufacturers cooperate with companies to carry out multi-level and multi-purpose utilisation of used power batteries.[59] China Tower, which operates 2 million telecom towers, has signed partnership agreements with more than 16 electric vehicles and battery manufacturers to replace the tower lead-acid battery with second-life lithium-ion batteries. These policy incentives can also be applied to solar, wind and hydrogen value chains.

Exchange data among industry players

Information exchange is essential to scale up circular economy strategies such as repair, refurbishing, and recycling. Governments typically subsidise offshore wind farms for the first 15–20 years of operation, but this does not mean that they have reached their end of life at the end of this period. Therefore, it is in the interest of the farm owners to extend the life of the turbines through maintenance, repair, repower, or dismantling. Available monitoring data is essential for analysing operating conditions and assessing the fatigue of major components such as the turbine foundation or blades, but very often, this information is not available or shared. For example, when a turbine component is reused, all its historical data is lost.

The same applies for batteries: recyclers do not have information on the chemistry of second-hand batteries, and retrofitters do not have information on their performance either. Manufacturers of stationary storage systems do not receive information on battery pack design or material composition from vehicle manufacturers.[60]

Recommended action 7: Policymakers should promote the exchange of data among key stakeholders for all renewable equipment through the introduction of product passports.

Following a legislative proposal from the European Commission, starting from 2026, all batteries on the EU market with a capacity of over 2 kWh will need to have a battery passport.[61] The passport will provide reliable information on every stage of the battery’s life such as materials chemistry, origin, general condition, and chain of custody. The passport will enable second-life operators to take informed business decisions and allow recyclers to better plan their operations and improve recycling efficiency. This proposal will likely be extended to other products by 2027, according to the upcoming Ecodesign for Sustainable Products Regulation.[62] Product passports have been made technically possible thanks to digital technologies, such as cloud, blockchain and digital platforms. Similarly, China’s policies require the establishment of an energy vehicle power battery traceability management platform to ensure batteries can be tracked and recycled once retired.

A product passport for photovoltaic panels could also improve the economics of repair, refurbishment, and recycling. This passport could track and disclose information such as material content, presence of hazardous material, recycling and repair procedure, and usage. In Australia, the Circular PV Alliance is working on a panel profile database that will hold all the information associated with a panel that is certified for reuse, including test results, refurbishment works undertaken, and classification. The Circusol (circular business models for the solar power industry) project, funded by the European Commission, has experimented with the setting up of a database to record manufacturing, installation, and usage data of each product to facilitate repair, reuse, refurbishment, and recycling at the end of life.

Secure a second-hand market

Currently, the price of second-hand solar photovoltaic panels is not competitive, but this well may change in the future. Today, a second-hand photovoltaic panel is sold at approximately 70% of the price of a new one[63] but considering the costs of dismantling, transportation, and refurbishment, second-hand photovoltaic panels are not competitive, and the market remains underdeveloped. However, in the near future, second-hand solar panels may become cheaper due to their greater availability and the rising price of raw materials needed to manufacture new panels.

Lack of quality standards hinders the emergence of a second-hand market for photovoltaic panels. The absence of quality or performance guarantee certificates for second-life panels is not conducive to market development. In addition, assessing the condition and performance of second-hand panels is difficult and costly, and can amount to the cost of the panel itself, which is the case in Australia for example.[64] A quality standard, based on a common set of testing requirements and performance thresholds, should ensure the safety and reliability of second-hand panels.

Recommended action 8: Industry players should establish a quality standard for second-hand photovoltaic panels as well as lithium-ion batteries and wind turbine equipment and components.

International organisations with industry players are working on second-life battery safety standards. These standards, including UL 1974 and IEC 62933-5-3, classify batteries based on their performance for greater transparency on product supply and market demand.

Governments should also trigger the demand for used components and equipment. In Italy, unlike most other countries, refurbishments of already operating renewable energy plants, including wind farms, can access state incentives.[65]

CREATE THE RIGHT ECONOMY AND POLICY CONDITIONS

Remove financial barriers

The costs of collecting, sorting, and recycling equipment are high. For example, it costs about $15–$45 to recycle a photovoltaic panel in the United States.[66]

Recommended action 9: Policymakers should introduce Extended Producer Responsibility (EPR) measures for the entire renewable energy sector to ensure dedicated and sufficient funding for the treatment of end-of-life equipment.

Extended Producer Responsibility (EPR) is a policy approach under which producers are given a significant responsibility – financial and/or physical – for the treatment or disposal of post-consumer products.[67] Under the EPR principle, producers of equipment are responsible for financing the collection, sorting, and recycling of the products they placed on the market. The European Union has enforced EPR measures for batteries since 2006 and photovoltaic panels since 2014.[68],[69] Such responsibility could in principle provide incentives to prevent wastes at the source and promote product design and have an important role in regulating and incentivising reuse, for example by setting targets for a minimum percentage of refurbished components, which can be expressed in carbon savings.

Recommended action 10: Investors should rate their investments portfolio based on circular economy principles, considering critical material supply risks and the environmental impacts of the renewable energy sector,

The evaluation of investments can be measured in terms of the percentage of critical materials that can be effectively recovered at the end of life, recycled content or sales from circular products and services. However, these metrics are often specific to a business model and do not accurately measure the circularity of investments. Investors could use more advanced metrics such as Circulytics (Ellen MacArthur Foundation) or The Circular Transition Indicators (World Business Council For Sustainable Development) that measure a company’s entire circularity, not just products and material flows. Investors could also support a globally applicable label designed to enable developers and operators to demonstrate the circularity of renewable energy assets. They could leverage the FAST-Infra Sustainable Infrastructure Label (SI Label). The SI Label is designed to help drive more capital to sustainable infrastructure, including renewables. “Supporting the Transition to a Circular Economy” is one of the sustainability criteria used by the label. There are many other developments to classify and monitor sustainable investments (e.g., EU’s green taxonomy, sustainability-related financial disclosures and IFRS’s sustainable finance standards). These also need to consider the circular economy performance of projects as part of sustainability criteria, rather than relying solely on what the technology delivers for sustainability.

Remove policy barriers

Administrative burdens create barriers to extending the life of wind turbines. According to a recent study focused on Spain, the main blockers for repowering wind turbines are not due to technical or market limitations but mainly to regulatory or administrative barriers.[70] The obligation to apply for new planning and operating permits is an unnecessary administrative barrier. In 2016, only six EU member states have included definitions of repowering in their national legislation. And Italy is the only member state to have put in place incentives for repowering, while not a single European country has put in place shorter authorisation procedures for repowering projects.[71]

The length of lease contracts for wind farms, currently around 25 years, does not encourage manufacturers to design turbines for a longer life span. Turbines have been designed to match the duration of the lease contracts, but it is entirely possible to design turbines that last much longer than 25 years. For example, GE commercialises an onshore wind turbine with a 40-year life certificate that can reduce the levelized cost of energy of wind farms by up to 20%.[72]However, in 2014, the Scottish Planning Policy stated that wind farm sites should be suitable for use in perpetuity, and elsewhere in the UK leases have been extended to 50–60 years, enabling wind farms and components to be designed for greater durability.

Some regulatory barriers work against circular economy strategies. In the United States, to be eligible for a federal investment tax credit, a turbine must be new, i.e., not have more than 20% used parts. In the European Union, subsidised wind farms cannot be built with used parts from dismantled farms. Regulatory barriers also apply to photovoltaic panel reuse. In Australia for example, used panels do not receive the same incentives as new ones.[73] In the United States, local and state interconnection, fire, building, and electric regulations may directly prohibit the reuse of solar panels.[74]

The lack of policy incentives undermines circular economy strategies. Many countries do not adopt policy incentives for recycling, favouring de facto incineration or landfilling. In the United States, the cost of solar photovoltaic module recycling is often outweighed by cheaper, more accessible disposal options. As a result, less than 10% of US solar panels are recycled.[75] Similarly, wind turbine blades are cheaper to incinerate or to landfill than recycle.

Recommended action 11: Policymakers should revise existing policies that slow the transition of the renewable energy sector to a circular economy.

Identifying specific regulatory barriers, some governments have started to act. For example, Scottish Planning Policy stated in 2014 that wind farm sites should be suitable for use in perpetuity. In the UK, leases have been extended to 50-60 years enabling wind farms and components to be designed for greater durability.

In the short term, enable investment in recycling technologies

Significant capital investments in recycling technologies and infrastructures are required. While recycling is the option of last resort as it involves the loss of the embedded value in products and components, investing in recycling technologies remains critical to recover materials, especially for photovoltaic, wind turbine, and batteries that are not currently designed for life extension. In 2030, recycling capacities for end-of-life batteries will need to be increased by a factor of more than 25 compared to today.[76] Some electrolysis cells used for hydrogen production use iridium, one of the scarcest elements on earth. To meet the future demand for iridium it will be essential to develop recycling infrastructure for iridium catalysts with technical end-of-life recycling rates of at least 90%.[77]

Investing in recycling infrastructures is not always attractive and certainly risky. Lithium-ion recycling facilities are costly to build and operate and require sophisticated equipment to treat harmful emissions generated by the smelting process and manage fire risk. They also do not recover all the valuable battery materials at their highest value. For photovoltaic module, the current low volumes, the limited availability of recycling technologies, the logistic challenges, and the undeveloped markets for recovered materials make recycling a low-revenue option globally, according to the International Energy Agency.[78] In addition, with rapidly evolving technologies, companies considering investing in lithium-ion battery recycling are concerned whether a different type of battery chemistry (such as solid-state battery) or vehicle propulsion system (like hydrogen-powered fuel cells) will gain a major foothold on the market in coming years thereby lowering the demand for recycling existing lithium-ion batteries. Furthermore, by 2030, the materials used are likely to shift from nickel, cobalt, and manganese to more abundant and less expensive materials such as sulphur, forcing down recycling revenues and margins.[79]

Recommended action 12: Policymakers should fund research and development on recycling technologies to relieve the existing barriers and spur private investment.

Improved recycling technologies will be key to recover more and higher quality materials. Therefore, some governments started funding large research projects. For example, as part of the US Inflation Reduction Act, the Department of Energy launched a $335 million program to support battery recycling. Funded under the European Union H2020 programme, the PHOTORAMA project develops a recycling technology, based on delamination, that preserves the purity of valuable materials, such as crystalline polysilicon and silver.

Recommended action 13: Investors should increase investments in the growing battery recycling market and the emerging photovoltaic recycling market.

The global lithium-ion battery recycling market, driven by volumes, regulations and demand for materials and evaluated at €390 million in 2020, is projected to reach €1.8 billion by 2027, growing at a CAGR of 24%.[80] Several deals have already been completed, such as the recycling company Redwood Materials which raised $700 million and Ascend Elements which secured $200 million in Series C equity investments. The trend is expected to accelerate in the coming years.

Until now, photovoltaic recycling has been a low-revenue option, but new delamination technologies, which separate photovoltaic cells from the glass plate in an effective way, should enable the recovery of the most valuable materials from end-of-life panels. For example, recycling company ROSI raises €7.4 million in equity from the Japanese group ITOCHU Corporation. The photovoltaic panel recycling market is expected to be worth €2.6 billion by 2030, up from €162 million in 2022.[81]

DISCLAIMER

This report has been commissioned by the Green Purposes Company Ltd, and represents the views of GATE C, the authors.

GATE C has exercised care in the preparation of the report, and it has used information it believes to be reliable. However, GATE C makes no representations and provides no warranties to any party about any of the report’s content (including the accuracy, completeness, and suitability for any purpose of any of that content). GATE C (and its related people and entities and their employees and representatives) shall not be liable to any party for any claims or losses of any kind arising in connection with, or as a result of, the use of or reliance on information contained in this report.

This report, whether in full or as a part extract, may not be reproduced, quoted or distributed without the written permission of Green Purposes Company and GATE C – such consent shall not be unreasonably withheld.

This report should be cited as follow:

For a circular energy transition: Action Plan for Industry, Policymakers and Investors GATE C. (commissioned by the Green Purposes Company).

© Green Purposes Company, February 2023

ENDNOTES

[1] Finance Earth. 2021. A Market Review of Nature-Based Solutions: An Emerging Institutional Asset Class (commissioned by the Green Purposes Company).

[2] International Energy Agency, Net Zero by 2050: a Roadmap for the Global Energy Sector, October 2021.

[3] International Energy Agency, Net Zero by 2050: a Roadmap for the Global Energy Sector, October 2021.

[4] International Energy Agency, Net Zero by 2050: a Roadmap for the Global Energy Sector, October 2021.

[5] International Energy Agency, Net Zero by 2050: a Roadmap for the Global Energy Sector, October 2021.

[6] International Renewable Energy Agency, Solar PV, 2022.

[7] International Energy Agency, The Role of Critical Minerals in Clean Energy Transitions, Mars 2022.

[8] The production of a terawatt-hour of electricity from photovoltaics can consume 300% more metal than the production of a terawatt-hour from a gas power plant.

[9] A single car lithium-ion battery pack contains around 8 kg of lithium, 35 kg of nickel, 20 kg of manganese and 14 kg of cobalt.

[10] The supply lithium, graphite, cobalt, nickel, and rare earths will need to increase respectively by factors of 42, 25, 21, 19 and 7 in 2040 compared to 2020 levels.

[11] International Energy Agency, The Role of Critical Minerals in Clean Energy Transitions, Mars 2022.

[12] International Energy Agency, The Role of Critical Minerals in Clean Energy Transitions, Mars 2022.

[13] CSIS, Safeguarding Critical Minerals for the Energy Transition, January 2022.

[14] The levelized cost of electricity is measure of the average total cost of electricity over the life of a generation asset. It is used to compare the cost of different methods of electricity generation.

[15] International Renewable Energy Agency, Renewable Power Generation Costs in 2021, 2022.

[16] International Renewable Energy Agency, Renewable Power Generation Costs in 2021, 2022.

[17] International Energy Agency, Critical minerals threaten a decades-long trend of cost declines for clean energy technologies, May 2022.

[18] National Renewable Energy Laboratory, Solar Photovoltaic Module Recycling: A Survey of U.S. Policies and Initiatives, 2021.

[19] International Energy Agency, Special Report on Solar PV Global Supply Chains, July 2022.

[20] U.S. Department of Energy, Research Plan to Reduce, Recycle, and Recover Critical Materials in Lithium-Ion Batteries, June 2019.

[21] International Renewable Energy Agency, End-of-life management: Solar Photovoltaic Panels, 2016.

[22] Atasu Atalay et al., The Dark Side of Solar Power, Harvard Business Review, June 2021.

[23] Pu Liu, Claire Y. Barlow, Wind turbine blade waste in 2050, Waste Management, 2017.

[24] International Energy Agency, The Role of Critical Minerals in Clean Energy Transitions, Mars 2022.

[25] International Energy Agency, The Role of Critical Minerals in Clean Energy Transitions, Mars 2022.

[26] Source: Ellen MacArthur Foundation.

[27] http://www.siemensgamesa.com.

[28] Ian Marius Peters et al., The value of stability in photovoltaics, Joule, 2021.

[29] Offshore Renewable Energy (ORE) Catapult, The End of Life Materials Mapping for Offshore Wind in Scotland, July 2022.

[30] Sajjad Mahmoudi et al., Environmental impacts and economic feasibility of end of life photovoltaic panels in Australia: A comprehensive assessment, Journal of Cleaner Production, 2020.

[31] Achim Kampker, Battery pack remanufacturing process up to cell level with sorting and repurposing of battery cells, Journal of Remanufacturing, 2021.

[32] Offshore Renewable Energy (ORE) Catapult, End-of-life planning in offshore wind, April 2021.

[33] International Energy Agency, Special Report on Solar PV Global Supply Chains, July 2022.

[34] International Renewable Energy Agency, End-of-life management: Solar Photovoltaic Panels, 2016.

[35] U.S. Department of Energy, Research Plan to Reduce, Recycle, and Recover Critical Materials in Lithium-Ion Batteries, June 2019.

[36] International Energy Agency, The Role of Critical Minerals in Clean Energy Transitions, Mars 2022.

[37] Yanyan Zhao et al., A Review on Battery Market Trends, Second-Life Reuse, and Recycling, Sustainable Chemistry, 2021.

[38] Global Battery Alliance, A Vision for a Sustainable Battery Value Chain in 2030: Unlocking the Full Potential to Power Sustainable Development and Climate Change Mitigation, September 2019.

[39] Global Battery Alliance, A Vision for a Sustainable Battery Value Chain in 2030: Unlocking the Full Potential to Power Sustainable Development and Climate Change Mitigation, September 2019.

[40] ARUP, Circular batteries: Circular business models for the lithium-ion battery industry,

[41] Nafsika Stavridou et. Al, Lattice and Tubular Steel Wind Turbine Towers. Comparative Structural Investigation, Energies, 2020.

[42] International Energy Agency, The Role of Critical Minerals in Clean Energy Transitions, Mars 2022.

[43] https://modvion.com.

[44] https://ascendelements.com.

[45] Heath Garvin A. et al., A critical review of the circular economy for lithium-ion batteries and photovoltaic modules – status, challenges, and opportunities, Journal of the Air & Waste Management Association, 2022.

[46] Achim Kampker et al, Battery pack remanufacturing process up to cell level with sorting and repurposing of battery cells, Journal of Remanufacturing, 2021.

[47] International Renewable Energy Agency, End-of-life management: Solar Photovoltaic Panels, 2016.

[48] Enel, Circular Economy Enel Position Paper, December 2020.

[49] International Energy Agency, PV Module Design for Recycling Guidelines, 2021.

[50] European Commission, Impact assessment report accompanying the document Proposal for a Regulation of the European Parliament and of the Council concerning batteries and waste batteries, repealing Directive 2006/66/EC and amending Regulation (EU) 2019/1020, 2020.

[51] International Energy Agency, Special Report on Solar PV Global Supply Chains, July 2022.

[52] McKinsey & Company, Second-life EV batteries: The newest value pool in energy storage, April 2019.

[53] Global Battery Alliance, A Vision for a Sustainable Battery Value Chain in 2030: Unlocking the Full Potential to Power Sustainable Development and Climate Change Mitigation, September 2019.

[54] Boston Consulting Group, The Case for a Circular Economy in Electric Vehicle Batteries, September 2020.

[55] Anne P.M. Velenturf et al., Reducing material criticality through circular business models: Challenges in renewable energy, One Earth, 2021.

[56] ITOCHU, ITOCHU Announces Signing of Capital and Business Alliances with ROSI, a Solar Panel Recycling Business Operator, 2022.

[57] European Commission, Proposal for a Regulation of the European Parliament and of the Council concerning batteries and waste batteries, repealing Directive 2006/66/EC and amending Regulation (EU) No 2019/1020, 2020.

[58] EY-Parthenon, 10 ways to help build a thriving battery recycling industry in Europe, September 2022.

[59] Zhe Wang, Analysis of Lithium Battery Recycling System of New Energy Vehicles under Low Carbon Background, IOP Conference Series: Earth and Environmental Science, 2020.

[60] Martin F. Börner, et al., Challenges of second-life concepts for retired electric vehicle batteries, Cell Reports Physical Science, 2022.

[61] European Commission, Proposal for a Regulation of the European Parliament and of the Council concerning batteries and waste batteries, repealing Directive 2006/66/EC and amending Regulation (EU) No 2019/1020, 2020.

[62] European Commission, Proposal for a Regulation of the European Parliament and of the Council establishing a framework for setting ecodesign requirements for sustainable products and repealing Directive 2009/125/EC, 2022.

[63] International Renewable Energy Agency, End-of-life management: Solar Photovoltaic Panels, 2016.

[64] ARUP, Circular photovoltaics: Circular business models for Australia’s solar photovoltaics industry, 2019.

[65] FER1 Decree.

[66] U.S. Department of Energy, Solar Energy Technologies Office Photovoltaics End-of-Life Action Plan, March 2022.

[67] Source: Organisation for Economic Co-operation and Development.

[68] Directive 2006/66/EC of the European Parliament and of the Council of 6 September 2006 on batteries and accumulators and waste batteries and accumulators and repealing Directive 91/157/EEC.

[69] Directive 2012/19/EU of the European Parliament and of the Council of 4 July 2012 on waste electrical and electronic equipment (WEEE).

[70] Miguel de Simón-Martín et al., Multi-dimensional barrier identification for wind farm repowering in Spain through an expert judgment approach, Renewable and Sustainable Energy Reviews, 2022.

[71] WindEurope, Repowering and Lifetime Extension: making the mist of Europe’s wind resource, June 2017.

[72] Reuters Events, GE’s 40-year turbine life certificate could cut costs by 20%, July 2019.

[73] ARUP, Circular photovoltaics: Circular business models for Australia’s solar photovoltaics industry, 2019.

[74] National Renewable Energy Laboratory, A Circular Economy for Solar Photovoltaic System Materials: Drivers, Barriers, Enablers, and U.S. Policy Considerations, 2021.

[75] National Renewable Energy Laboratory, Solar Photovoltaic Module Recycling: A Survey of U.S. Policies and Initiatives, March 2021.

[76] Global Battery Alliance, A Vision for a Sustainable Battery Value Chain in 2030: Unlocking the Full Potential to Power Sustainable Development and Climate Change Mitigation, September 2019.

[77] Christine Minke et al., Is iridium demand a potential bottleneck in the realization of large-scale PEM water electrolysis?, International Journal of Hydrogen Energy, 2021.

[78] International Energy Agency, Status of PV Module Recycling in Selected IEA PVPS Task 12 Countries, 2022.

[79] BCG, The Case for a Circular Economy in Electric Vehicle Batteries, September 2020.

[80] Research and Markets, Lithium-Ion Battery Recycling Market – Forecasts from 2022 to 2027, August 2022.

[81] Rystad Energy, Reduce, reuse: Solar PV recycling market to be worth $2.7 billion by 2030, July 2022.

Connect with our circular economy consultants to know more